Chapter 1: The Contraction

1929

The New York Democratic Party had manpower problems. William Hackett was planning to run for governor but would die in 1926 after a traumatic brain injury sustained from a car crash in Cuba. The party then pushed for Edwin Corning who would also suffer health issues and decline to run. On and on it went, to Robert Wagner, George Lunn and Peter Ten Eyck who would all fail to receive enough support. Eventually, former governor and current presidential candidate Al Smith would endorse one Franklin Delano Roosevelt, fifth cousin of ex-president Theodore Roosevelt and former Assistant Secretary of the Navy. Roosevelt had given a speech in favor of Smith in 1924 and would continue to support him into 1928, which might have lead to him clinching Smith's support. He would run on a campaign of anti-corruption and be inaugurated as Governor of New York on January 1st, 1929 after winning by a narrow margin of 49 to 48%.

On March 4th, Herbert Hoover, Industrialist and Humanitarian extraordinaire would be inaugurated as president of the United States after 8 years as the republican Secretary of Commerce. Voters liked what they saw in their pocket books and Hoover would win in a blowout 58.2 to 40.8% against Al Smith, preserving continuous republican rule since the end of the Great War. It was a time of hope as markets repeatedly rallied in expectation of future growth.

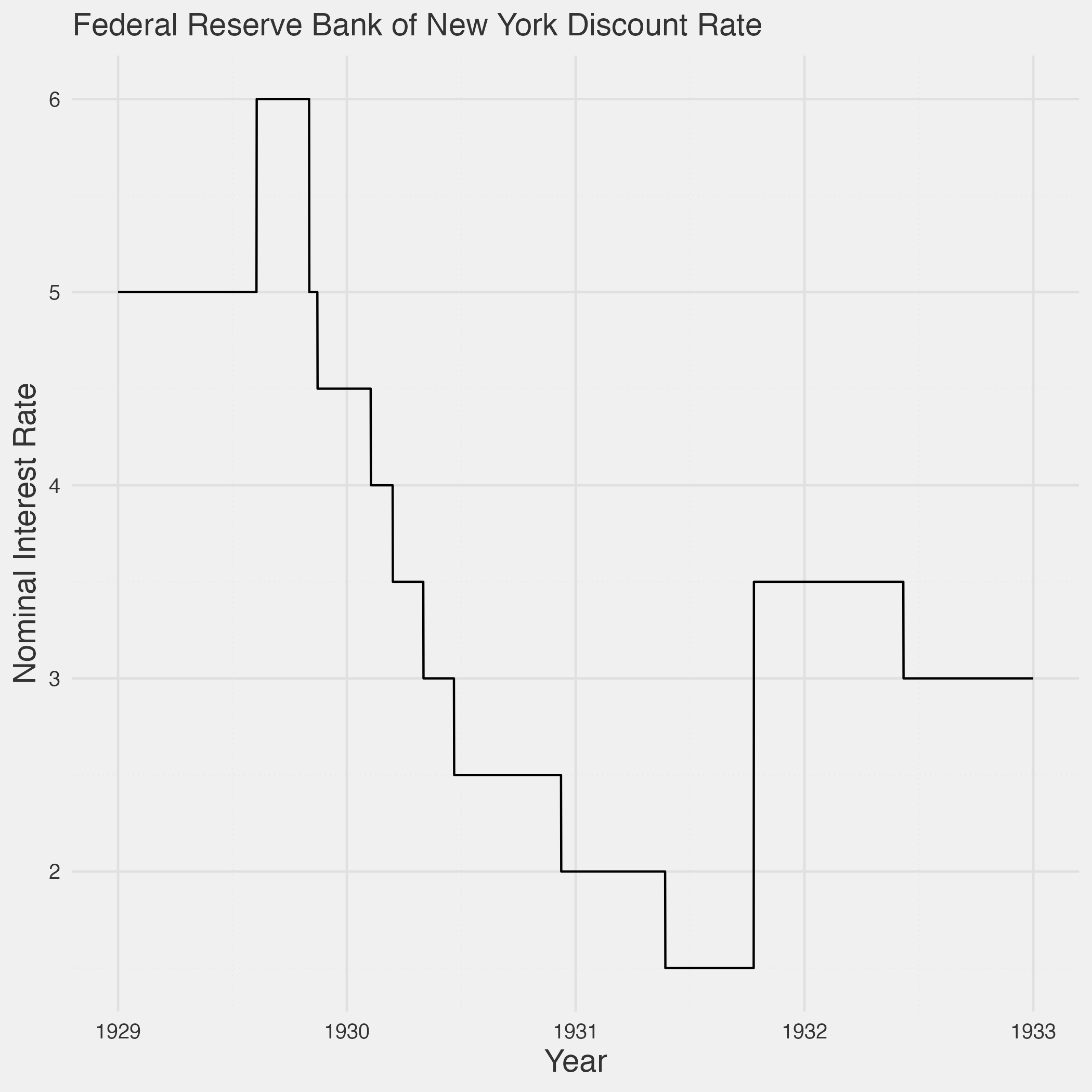

Following the health decline and eventual death of Benjamin Strong in October 1928, the expansionary policies of the New York Fed were reduced. Rather than trying to accommodate the overvalued pound, George Harrison was convinced there was a bubble in the stock market and the exuberance must be quashed. Harrison convinced the board to increase the discount rate from 5 to 6% on August 9th. The Bank of England would respond by reducing its discount rate but gold would rapidly drain out of the economy before they were forced to raise rates again on September 29th. August saw a 1% decline in industrial production from the July peak as market volatility increased.

On October 28th, confidence collapsed and the Dow dropped 13% in an event known as Black Monday. The next day, the Dow declined an additional 12% bringing the aggregate down to 198. The markets could feel in their bones that something was deeply wrong in America. October's industrial production was 3.4% lower than July. The Federal Reserve Bank of New York had gotten their wish, equity prices had dropped from their earlier highs.

Across New York, folks would gossip about stock traders leaping out of skyscrapers following the precipitous falls. Despite its plausibility, suicides were rare after the crash. According to the Chief Medical Examiner of New York, Charles Norris, only 44 suicides had occurred in the month of and after the crash compared to 53 in the same period of 1928. However, suicide rates would continue to rise in response to general economic malaise, peaking in 1932, 20% higher than they were in 1929.

The New York Fed responded by dropping the discount rate back down to 5% on November 1st, wanting to accommodate the plunge without doing anything too expansionary which would repeat the mistakes leading to the "bubble". The markets continued to plunge, reaching half of their peak in mid-November. They lowered rates once more to 4.5% on November 15th. November's Industrial production was 8.1% lower than July.

In 1929 the US economy was 104.6 billion dollars strong with 120.4 billion hours worked across the nation. Layoffs had been rolling for the last couple months as production dropped. Avid readers of newspapers would notice the disconcerting absence of help wanted requests in between pages on stock market drops and factory closures.

1930

Despite a moderate improvement in the stock market, with the Dow reaching 267, the New York Federal Reserve reduced the discount rate to 4% on February 7th, citing continued declines in industrial production—now 12.5% below July's peak.

"The Dow continued to rise, peaking at 294 in March. However, industrial production slipped further, 13.9% below its peak by that time. In response, the New York Federal Reserve cut the discount rate to 3.5% on March 14th. Further cuts followed: down to 3% on May 2nd, while the Dow stabilized but industrial production dropped to 15.9% below the previous July.

June brought another rate cut on the 20th while the Dow dropped precipitously. The senate passed the most extreme tariff proposal in US history by a 44-42 vote on the 17th, prompting retaliatory tariffs across the world, further lowering international trade. Industrial production was 18.3% under the apex and the situation would continue to slip the Fed's control.

Despite the rate cut, by December, industrial production plummeted to 30.5% below its July 1929 level, and the Dow hit a year low of 157. The New York Federal Reserve lowered its discount rate once more to 2% in an attempt to stabilize the economy.

Through the latter half of 1930, bank closures became a common story across America. According to Gary Richardson of the Federal Reserve Bank of Richmond:

Caldwell was a rapidly expanding conglomerate and the largest financial holding company in the South. It provided its clients with an array of services – banking, brokerage, insurance – through an expanding chain controlled by its parent corporation headquartered in Nashville, Tennessee. The parent got into trouble when its leaders invested too heavily in securities markets and lost substantial sums when stock prices declined. In order to cover their own losses, the leaders drained cash from the corporations that they controlled.

On November 7, one of Caldwell’s principal subsidiaries, the Bank of Tennessee (Nashville) closed its doors. On November 12 and 17, Caldwell affiliates in Knoxville, Tennessee, and Louisville, Kentucky, also failed. The failures of these institutions triggered a correspondent cascade that forced scores of commercial banks to suspend operations. In communities where these banks closed, depositors panicked and withdrew funds en masse from other banks. Panic spread from town to town. Within a few weeks, hundreds of banks suspended operations. About one-third of these organizations reopened within a few months, but the majority were liquidated.

Panic began to subside in early December. But on December 11, the fourth-largest bank in New York City, Bank of United States, ceased operations. The bank had been negotiating to merge with another institution. The New York Fed had helped with the search for a merger partner. When negotiations broke down, depositors rushed to withdraw funds, and New York’s superintendent of banking closed the institution. This event, like the collapse of Caldwell, generated newspaper headlines throughout the United States, stoking fears of financial panics and currency shortages like the panic of 1907 and inducing jittery depositors to withdraw funds from other banks.

On December 12, Columbia University hosted a lecture by British economist John Maynard Keynes, who discussed the recent recession and potential responses. Frightened by the bank collapse, Governor Franklin D. Roosevelt, attended the event to see his acquaintance from the peace negotiations. (Point of Divergence: FDR is somewhat healthier and becomes friends with Keynes during Versailles rather than Hoover doing so). The two would catch up and promise to talk to each other more.

By the end of 1930, only 112.7 billion labor hours were recorded, representing a decline of 6.4% from the previous year. The Gross Domestic Product fell to 92.16 billion 1929 dollars. Prices had fallen 6% and were expected to drop further, raising the real return on cash to 6.4% and the real discount rate to 8.4%, well above the pre-depression real rates of 5-6%[1]. This contractionary monetary policy would continue to depress spending and further the deflationary spiral. The Fed cut rates faster than it ever had before, and managed to outpace deflation until April but the deflationary pressure proved too strong and real rates would continuously increase for the next year.

One would expect that banks as owners of large sums of debt such as mortgages would benefit from the deflation due to its appreciation in real value but one must remember that bank deposits are liabilities owed to customers. Their assets and liabilities would both increase in value due to deflation, but waves of foreclosures would tilt the scale towards default. Seeing these risks and the strings of prior bank runs, depositors rushed to withdraw putting further pressure on banks. In response banks hoarded reserves by ceasing lending in an effort to stave off runs, reducing access to credit and worsening the economic situation. Radical action was needed, radical action that wouldn't come.

[1]: This isn’t quite true as there were not expectations of deflation as there usually aren’t under a gold standard. Realized real rates were high which hurt borrowers, but they wouldn’t know it at the time.

1931

A nation, whose money decreases, is actually, at that time, weaker and more miserable then another nation, which possesses no more money, but is on the encreasing hand. This will be easily accounted for, if we consider, that the alterations in the quantity of money, either on one side or the other, are not immediately attended with proportionable alterations in the price of commodities. There is always an interval before matters be adjusted to their new situation; and this interval is as pernicious to industry, when gold and silver are diminish-ing, as it is advantageous when these metals are encreasing?...

It is also evident, that the prices do not so much depend on the absolute quantity of commodities and that of money, which are in a nation, as on that of the commodities, which come or may come to market, and of the money which circulates. If the coin be locked up in chests, it is the same thing with regard to prices, as if it were annihilated.

- David Hume, "Of Money" page 40 and 42

Throughout the world, “coin [was] locked up in chests” as banks increased reserves and consumers increased their savings in part due to the increased return on cash and in part as a response to risks of unemployment. Although prices had dropped, the flow of money had dropped faster and that difference was the fall in real output, now 90.9 billion 1929 dollars over the year. This constituted a decline of 13.1% and coupled with the 15.2% decline in prices would correspond to the 26.3% [2] total decline in nominal gross domestic product.

Factories increasingly went idle as demands for products such as automobiles dried up. Idle factories led to unemployed workers furthering lowering demand in a vicious cycle. All in all, across 1931, employment declined further with 102.8 billion hours having been worked across the year, a decline of 14.6% since 1929.

January to April would act as a reprieve from the constant drops leading many commentators to call the bottom of the contraction. On January 2nd, the British and French would meet to try halting Britain's gold outflows. The next day, France would cut its discount rate by 50 basis points, both boosting the Dow. For the next couple months, France's gold stocks would stop increasing letting the UK increase theirs. This shift in gold flows to England instead of France was overall stimulatory for the world economy as the UK's gold reserve ratio was lower, increasing the amount of currency in the world despite gold supply remaining fixed.

The Nationalsozialistische Deutsche Arbeiterpartei, henceforth called the Nazi party, was harshly against international cooperation and the payment of reparations. Although they had grown in power since before the depression, they had been successfully locked out of governance and unable to create much risk for international finance.

In May, the Federal Reserve Bank of New York would lower its discount rate one final time to 1.5%. At the same time, Creditanstalt, the largest Austrian commercial bank would experience a run and collapse. Gold fled Europe, despite the low rates in America, as the contagion spread to Germany, where the central bank had its own run and capital controls were imposed in July. As news of Germany's fate spread to the UK, traders expected the Bank of England to follow soon, pounding the pound. Fears over the new German-Austrian customs union and the defeat of the internationalist Briand in the French presidential election prevented much coordination from occurring.

Despite general fear and the destructive catalysts, certain men in britain had been cheering abandonment from the start such as Keynes. He argued that adherence to gold convertibility limited the options policy makers could take to respond to the depression. If the currency floated freely, much more monetary stimulus could occur without gold outflows to worry about. As wages hadn't fully adjusted to the new prices, if prices were to be reflated by increasing aggregate demand, the pre-depression equilibrium could be returned to and the level of employment with it. Under his insistence and the immense pressures imposed by traders, the peg was withdrawn on September 21st and the pound's value immediately fell surprising many [3] by its suddenness.

Across the Atlantic, another crisis was brewing. As investors witnessed what happened across Europe, they became increasingly worried about a similar situation happening in the US. Gold poured out of the US dollar and towards personal stores between June 1927 and 1931, the stock of privately held gold would decline $50 million a year but it would increase by $405 million(4.5% of all the gold in the world's monetary stock) between June 1931 and 1932. To prevent a collapse similar to the one in England, the New York Fed was forced to raise rates 200 basis points to 3.5% in October. This would only put further downwards pressure on the economy but it was deemed necessary to maintain the peg. Despite the interest rate hikes, private gold hoarding would continue to increase, drastically shrinking the monetary base. The Fed was in a truly terrible situation, raising rates to keep gold in the system would hamper credit but keeping them flat would lead to a shrinking money supply. European central banks facing possible central bank collapses would increasingly hold gold further contracting the world economy.

Although there were initial hopes for international cooperation where many countries would pursue a more expansionary policy to prevent gold flows, hope would gradually dry up with every additional day of intransigence. The death of Germany's internationalist Foreign Minister, Gustav Stresemann, in 1929 and the New York Fed's Benjamin Strong in 1928 would lay the groundwork for the end of international cooperation. Strong had been happy to maintain the price level throughout the 20s and accommodate Britain's overvalued currency, the change in policy would be visible across the great depression as price level rapidly dropped and Britain was left high and dry in late 1929. Increasingly negative sum contractionary policy across the world would act as an additional feedback loop depressing the economy.

The lack of cooperation was so damaging that Irving Fisher would say "gold disarmament is just as difficult of attainment as is military disarmament. No greater problem exists today than a possible gold shortage". FDR's general interest in economics and growing popularity within the Democratic Party would induce Fisher to establish a relationship. On one of Roosevelt's now frequent stops at Columbia, he would introduce himself. He too recommended a shift from a gold standard to a commodity standard based on 1924-1926 prices. Despite his poor reputation from his prediction in late 1929 that stocks had reached a "permanently high plateau", he would be brought on as an advisor on economic policy during FDR's presidential campaign.

As the situation became less tenable in Germany, markets increasingly expected a renegotiation of the Young Plan for debt repayment and the Young Plan bonds dropped in price. Contrary to future linkage between values of the two, the US stock market would rise upon rumors of US officials being sent to Europe where YPB prices dropped.

Over the course of these crises and his correspondence with Keynes, Roosevelt would increasingly become convinced that the US would also have to cast aside its gold peg in order to prevent further deterioration. While pondering monetary policy, he would put his power as governor to good use: the large scale funding of public works. State funding would be granted to the Independent Subway System to further its construction in addition to various dams along the Saint Lawrence river along with the Attica Correctional Facility.

In addition, The Metropolitan Reconstruction Corporation would be formed with an initial transfer of $50 million with which it could borrow up to $500 million for the purposes of redevelopment and employment within New York City. It would plan to receive an additional $20 million per annum in subsequent years. Chaired by Clarence Stein who briefly chaired the New York State Housing and Regional Planning Commission, it would engage in slum clearance and redevelopment around the new Independent stations. Frequently it would pay workers with food, housing, small stipends and the promise of a future home of their own.

Despite the lack of explicit directives demanding segregation, African American workers and displaced renters would mostly be given the promise of housing in The Bronx and northern Manhattan whereas various white ethnic groups present in tenements would be given promises of housing in Brooklyn or the new units on the East Side.

Areas directly surrounding new stations would aim for densities of around 100-300 persons per acre depending on the distance from Manhattan. Units were split into 4 main categories:

- Worker owned units used as compensation for the construction work. These varied from smaller units in flats which would be owned outright as a condominium to larger buildings such as an entire row-house which required a 10 year mortgage to pay for a portion of it. 40% of units in buildings owned by the MRC would be in this category.

- Privately owned units either as entire buildings or units in a condominium. These would be sold on the open market subject to regular market pressures.

- Market rents would be charged for some buildings that had continued government ownership. Around 30% of units in buildings owned by the MRC would fall under this category.

- Low rent housing would be provided in an experiment to quell the homelessness which had been rising throughout the depression. Typically this would be priced at around half of market rents and would require possible renters to prove that they were of good moral character and were of sufficient need. In practice, this was used to prevent African Americans from making use of the program in predominantly white neighborhoods. This would make up the final 30% of units in MRC owned buildings.

This policy was unpopular with many and classified as government overreach by certain journalists but it would keep tens of thousands of New York construction workers with a steady income and escaped the scrapyard due to the crisis.

Sensing the pressures to unpeg and increasing willingness among politicians like Roosevelt, investors further withdrew gold to not be caught flat footed by a devaluation. The more gold was hoarded, the worse the economy would become further increasing pressures for and expectations of devaluation.

[2]: Percentages are weird. 0.869 * 0.848 = 0.737

[3]: We know that it was unexpected because 3 month forward discounts between the Dollar and the Pound were only 3 cents in August(a rise from the half cent earlier but still small). Similarly, bond prices almost entirely dropped on the 18th and 19th of September: From 104 on the 5 1/2 percent coupon in early September to 100 on September 18th and 92 on the 19th.

1932

Although industrial production is easier to track and would fall more drastically than real gdp, it wasn't the steepest contraction in an important metric. That honor would go to gross private investment in structures such as homes and factories. From 1929 to 1932, it would fall from 7.8 billion dollars to 1.4 billion dollars. The wave of home building and industrial expansion of the 20s had ended and over a third of the unemployed were ex-builders. In fact, due to depreciation America's stock of capital would decline, scarring its capacity to produce in the future.

Most mortgages at the time were short-term(usually around 5 years), and non-amortized(the principal would not be paid off by normal payments). If you wanted to buy a house, you would take one of these loans and pay 7-12% interest a year, based on your creditworthiness among other things, before being responsible for the entire principle at the end. Normally people would then take out a moderately smaller loan as they refinance because although they wouldn't have saved enough to pay off the entire thing, they would've saved some money in the interim. As the great depression rolled around however, many would become unemployed and not make enough income to even pay off interest.

The other main form of a mortgage consisted of entrance into a building and loan association which were cooperative local organizations with an alternate payment structure. Instead of paying off the loan, debtors would buy shares of the B&L until they had reached the principal. Although such an institution was easier to get into, defaults were more severe as shares were forfeit and the full value of the debt was still owed. Rather than being a simple debt, B&Ls would saddle debtors with large directional bets on the value of the creditor; great when it moves in your favor, terrible if not. For most of the 1920s, B&Ls would appreciate in value but that would all change in late 1929.

As employees were laid off they had less income with which to buy B&L shares and thus defaults rose. Yet, all across the nation, incomes were falling and so too were home values. Rather than foreclosing on the house and selling it to recoup their loss, B&Ls would get pennies on the dollar. Banks faced similar problems and in response further reduced access to credit due to the increased risk. Debtors counting on the ability to take out new mortgages would find themselves defaulting and the situation would further reinforce itself. Such was the essence of the great depression, credit would dry up, causing credit to dry up further in endless cycles of decreasing demand and defaults.

Hoover’s frequent response was to pressure companies into keeping wages high. In November 1929 he asked industrial leaders to keep wages steady and he would continue to make similar demands throughout the Depression. Manufacturers generally listened to him, with nominal wages only falling 12% compared to the 29.6% decline in prices. This was great for those able to keep their jobs and hours but the higher cost of labor would lead to further layoffs with unemployment reaching a high of 28.1% in December 1932.

As June gave way to July in the sweltering Chicago summer, Democrats from across the nation converged on their quadrennial convention. Although Franklin D. Roosevelt had 765 delegates through successful primaries, he fell just shy of the two-thirds(769) required to clinch the nomination on the first ballot.

FDR's bold economic platform resonated most powerfully with western farmers and southerners at large, but he was able to rack up lopsided delegate hauls in reeling mill towns across Michigan, Pennsylvania, and Ohio.

Overnight, Roosevelt's Lieutenants would negotiate with Garner for a vice presidential position and nothing else, which was all that Garner's bargaining power would lend him. On the second ballot, he would be elected with a firm 930 delegates with some minor southern defections. In his acceptance speech he would say:

...Let it be from now on the task of our party to break foolish traditions. We will break foolish traditions and leave it to the republican leadership, far more foolish in that art, to break promises. This convention wants a new deal, your candidate wants a new deal and I am confident that the United States of America wants a new deal. I say to you now, that from this date on, Hoover's recession is doomed. I pledge myself to relief and recovery for the American People. Give me your help not to live votes alone, but to win in this crusade to restore America to its own people. [Music begins playing and Roosevelt walks off].

As the Democratic convention played out, a parallel drama was unfolding in the nation's capital. Thousands of World War I veterans, their families, and affiliated groups descended on Washington D.C. in late May 1932. Dubbed the "Bonus Army", these protesters sought to pressure Congress to immediately pay out certificates granted to them to compensate for wages lost during the war.

With the Depression raging and many veterans unable to find work, the certificates due in 1945 represented a potential lifeline. Led by organizers like Walter Waters and aided by allies like cannery worker leader "Crazy" Herb Corey, the Bonus Army established a series of ramshackle camps ringing Washington. At its peak, over 50,000 marchers established semi-permanent settlements on the Anacostia Flats.

Though the Bonus Army aimed to be peaceful, clashes with local police grew more common as the brutal D.C. summer dragged on in squalid conditions. On July 28th, two protesters were shot by regulating forces, inflaming tensions further. President Hoover, wary of the growing shantytown and negative optics, called in the U.S. Army to disperse the marchers. Led by Army Chief of Staff General Douglas MacArthur, the crackdown saw cavalry troops attack with gas(adamsite not mustard or chlorine gas), bayonets, and tanks as fires were set to the protesters' camps.

The violent military assault against desperate World War I veterans provoked national outrage. Newsreel footage of the crackdown airing in cinemas fueled a backlash against the incumbent Republican administration. Roosevelt would come out in favor of a partial early payment, increasing his support among veterans and perceived risk of currency devaluation.

If the value of assets or incomes relative to debts could be raised, the cycle could be broken but the gold peg meant that expansionary policy could be mostly eaten by private and central bank gold hoarding in response to increased fears of devaluation. The French Central Bank for example would switch out all of their dollar assets for gold over the course of 1932. Although a switch from Dollars to Francs would've been neutral, France's 100% gold reserve ratio policy meant that such actions were contractionary. In 1926 the Bank of France held 7% of monetary gold, but by 1932 it had reached a staggering 29% of world monetary gold, barely edging the Federal Reserve system in the US which had also kept 29% of monetary gold.

As the situation continued to worsen, GDP fell to 56.298 billion dollars in 1932 with 88.8 billion hours worked. The quantity of labor was 26.2% lower than 1929 while nominal GDP had declined 46.2% since its peak. Every missing dollar made it that much harder for debtors to service their debt. Bankruptcies skyrocketed across the nation as mortgages went unpaid for. As assets owned by banks became increasingly worthless, they responded by further hoarding reserves in an effort to stay afloat.